QuickLinks-- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant | ||

Filed by a Party other than the Registrant | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to | |

LEHMAN BROTHERS HOLDINGS INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

March 1, 2005

Dear Stockholder:

Stockholder,

The 20022005 Annual Meeting of Stockholders of Lehman Brothers Holdings Inc. will be held on Tuesday, April 9, 2002,5, 2005, at 10:30 a.m. (New York time) in the

12th Floor Auditorium of 399 Parkat our global headquarters, 745 Seventh Avenue, New York, New York 10022.10019, on the Concourse Level in the Allan S. Kaplan Auditorium. A notice of the meeting, a proxy card and a proxy statement containing information about the matters to be acted upon are enclosed. You are cordially invited to attend.

All holders of record of the Company's outstanding shares of Common Stock and Redeemable Voting Preferred Stock atas of the close of business on February 15,

200211, 2005 will be entitled to vote at the Annual Meeting. It is important that your shares be represented at the meeting. You will be asked to (i) elect three Class I Directors; and (ii) ratify the selection of Ernst & Young LLP as the Company's independent auditors for the 20022005 fiscal year.year by the Audit Committee of the Board of Directors; (iii) approve the 2005 Stock Incentive Plan; and (iv) consider a shareholder proposal. Accordingly, we request that you promptly sign, date and return the enclosed proxy card, or register your vote online or by telephone according to the instructions on the proxy card, regardless of the number of shares you hold.

Very truly yours,

[Signature]

Richard S. Fuld, Jr.

Chairman and Chief Executive Officer

LEHMAN BROTHERS HOLDINGS INC.

------------------

NOTICE OF 2002 ANNUAL MEETING OF STOCKHOLDERS

---------------------

745 Seventh Avenue

New York, NY 10019

![]()

LEHMAN BROTHERS HOLDINGS INC.

Notice of 2005 Annual Meeting of Stockholders

To the Stockholders of Lehman Brothers Holdings Inc.:

The 20022005 Annual Meeting of Stockholders of Lehman Brothers Holdings Inc. (the "Company") will be held on Tuesday, April 9, 2002,5, 2005, at 10:30 a.m. (New York time) inat the 12th Floor Auditorium of 399 ParkCompany's global headquarters, 745 Seventh Avenue, New York, New York 10022,10019, on the Concourse Level in the Allan S. Kaplan Auditorium, to:

- 1.

- Elect three Class I Directors for terms of three years each;

- 2.

- Ratify the selection of Ernst & Young LLP as the Company's independent auditors for the

20022005 fiscalyear;year by the Audit Committee of the Board of Directors; - 3.

- Approve the 2005 Stock Incentive Plan;

- 4.

- Consider a shareholder proposal; and

3. - 5.

- Act on any other business which may properly come before the Annual Meeting or any adjournment thereof.

Stockholders

Common stockholders of record atas of the close of business on February 15, 200211, 2005 are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

The Company will admit to the Annual Meeting (1) all Stockholders of record atas of the close of business on February 15, 2002,11, 2005, (2) persons holding proof of beneficial ownership as of such date, such as a letter or account statement from the person's broker, (3) persons who have been granted proxies and (4) such other persons that the Company, in its sole discretion, may elect to admit. ALL

PERSONS WISHING TO BE ADMITTED MUST PRESENT PHOTO IDENTIFICATION. PERSONS

ATTENDING THE ANNUAL MEETING MUST ENTER THE 399 PARK AVENUE BUILDING THROUGH ITS

LEXINGTON AVENUE ENTRANCE. IF YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE

CHECK THE APPROPRIATE BOX ON YOUR PROXY CARD OR REGISTER YOUR INTENTION WHEN

VOTING ONLINE OR BY TELEPHONE ACCORDING TO THE INSTRUCTIONS PROVIDED.

All persons wishing to be admitted must present photo identification. If you plan to attend the Annual Meeting, please check the appropriate box on your proxy card or register your intention when voting online or by telephone according to the instructions provided.

A copy of the Company's 2004 Annual Report to Stockholders is enclosed herewith for all Stockholders other than Lehman Brothers employees, to whom the Annual Report is being separately distributed.

By Order of the Board of Directors

[Signature]

![]()

Jeffrey A. Welikson

Corporate Secretary

New York, New York

February 28, 2002

March 1, 2005

WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE ANNUAL MEETING, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT IN THE ENCLOSED PREPAID ENVELOPE, OR REGISTER YOUR VOTE ONLINE OR BY TELEPHONE ACCORDING TO THE INSTRUCTIONS ON THE PROXY CARD.

PROXY STATEMENT TABLE OF CONTENTS

| Page | ||

|---|---|---|

| Introduction | 1 | |

Security Ownership of Principal Stockholders | 4 | |

Proposal 1—Election of Class I Directors | 4 | |

Nominees for Election as Class I Directors to Serve until the 2008 Annual Meeting of Stockholders | 5 | |

Class III Directors whose Terms Continue until the 2006 Annual Meeting of Stockholders | 6 | |

Class II Directors whose Terms Continue until the 2007 Annual Meeting of Stockholders | 7 | |

Committees of the Board of Directors | 8 | |

Non-Management Directors | 10 | |

Attendance at Meetings by Directors | 10 | |

Compensation of Directors | 10 | |

Executive Officers of the Company | 12 | |

Security Ownership of Directors and Executive Officers | 13 | |

Compensation Committee Report on Executive Officer Compensation | 14 | |

Compensation and Benefits Committee Interlocks and Insider Participation | 17 | |

Compensation of Executive Officers | 18 | |

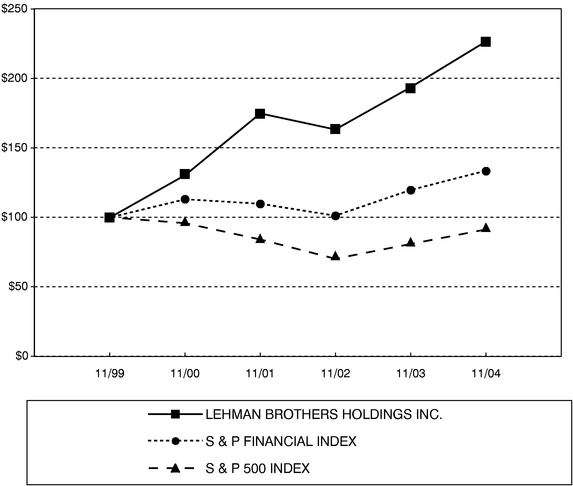

Performance Graph | 23 | |

Director Independence | 24 | |

Certain Transactions and Agreements with Directors and Executive Officers | 26 | |

Proposal 2—Ratification of the Company's Selection of its Auditors | 30 | |

Ernst & Young LLP Fees and Services | 30 | |

Audit Committee Report | 32 | |

Proposal 3—Approval of the 2005 Stock Incentive Plan | 33 | |

Proposal 4—Shareholder Proposal Regarding CEO Compensation | 40 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 42 | |

Other Matters | 42 | |

Directions to the Lehman Brothers Holdings Inc. 2005 Annual Meeting of Stockholders | 44 | |

APPENDIX A—Audit Committee Charter | A-1 | |

APPENDIX B—2005 Stock Incentive Plan | B-1 |

![]()

LEHMAN BROTHERS HOLDINGS INC.

745 Seventh Avenue

New York, New YorkSEVENTH AVENUE

NEW YORK, NEW YORK 10019

February 28, 2002

------------------------

PROXY STATEMENT

---------------------

Proxy Statement

March 1, 2005

INTRODUCTION

VOTE BY PROXY.

Vote by Proxy

This proxy statement (the "Proxy Statement") is furnished in connection with the solicitation of proxies by the Board of Directors of Lehman Brothers Holdings Inc. (the "Company" and, together with its subsidiaries, the "Firm") for use at the 20022005 Annual Meeting of Stockholders of the Company, to be held on Tuesday, April 9, 20025, 2005 at 10:30 a.m. (New York time), or any adjournment thereof (the "Annual Meeting"). The Company expects to mail this Proxy Statement and the accompanying proxy card on or about March 2, 2005 to the Company's common stockholders of record atas of the close of business on February 15, 200211, 2005 (the "Stockholders") on or about

February 28, 2002.

.

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend in person, you are urged to complete, sign and date the enclosed proxy card and return it as promptly as possible in the enclosed, prepaid envelope, or to vote your shares online or by telephone according to the instructions on the proxy card. Stockholders have the right to revoke their proxies at any time prior to the time their shares are actually voted by (i) giving written notice to the Corporate Secretary of the Company, (ii) subsequently filing a later dated proxy or (iii) attending the Annual Meeting and voting in person. Please note that attendance at the meeting will not by itself revoke a proxy.

The enclosed proxy indicates on its face the number of shares of common or

voting preferred stock registered in the name of each Stockholder atas of the close of business on February 15, 200211, 2005 (the "Record Date"). Proxies furnished to Company employeesany Firm employee also indicate the numberfollowing amounts, as applicable:

- •

- The amount of shares

if any, (i)held by the employee under either the Lehman Brothers Holdings Inc. Employee Stock Purchase Plan (the"ESPP""Lehman ESPP"), (ii) that relate toor thetotal numberNeuberger Berman Inc. Employee Stock Purchase Plan (the "Neuberger ESPP"); - •

- The amount of restricted stock unit awards granted to the employee pursuant to various of the

Company'sIncentive Plans (as defined below), a portion of the underlying shares for whichsharesare held in,part,and will be voted in accordance with the employee's instructions by, the 1997 Trust Under Lehman Brothers Holdings Inc. Incentive Plans (the "Incentive Plans Trust"), (iii) held by the employee in a brokerage account at the Company's wholly owned subsidiary, Lehman Brothers Inc. ("LBI") and/or a brokerage account at Fidelity Brokerage Services LLC ("Fidelity Brokerage"), and (iv); - •

- The amount of shares held by the employee under the Lehman Brothers Savings Plan (the "Savings Plan");

- •

- The amount of restricted shares held by the employee pursuant to the 1999 Neuberger Berman Inc. Long-Term Incentive Plan (the "Neuberger LTIP") and/or the Neuberger Berman Inc. Wealth Accumulation Plan; and

- •

- The amount of shares held by the employee in a brokerage account at Lehman Brothers Inc. ("LBI") or Neuberger Berman, LLC ("NBLLC"), each of which is a wholly owned subsidiary of the Company, and/or a brokerage account at Fidelity Brokerage Services LLC ("Fidelity Brokerage").

Proxies returned by employees holding restricted stock units related to shares held in the Incentive Plans Trust will be considered to be voting instructions returned to the Incentive Plans Trust Trusteetrustee (the "Incentive

"Incentive Plans Trustee") with respect to the number of shares determined pursuant to the terms of the agreement governing the Incentive Plans Trust. The Incentive Plans Trustee shall implement

such voting instructionsTrust, as described below under "The Voting Stock." Proxies

returned by employees holding shares in an LBI or Fidelity Brokerage account

will be considered to be voting instructions returned to LBI or Fidelity

Brokerage, as applicable, with respect to such shares, and proxies returned by employees holding shares in the Savings Plan will be considered to be voting instructions returned to the Savings Plan trustee (the "Savings Plan Trustee") with respect to such shares, and Savings Plan shares for which no proxies are returned shall be voted in the same proportions as Savings Plan shares for which proxies are returned, as described below under "The Voting Stock." Proxies returned by employees holding shares in an LBI, NBLLC or Fidelity Brokerage account will be considered to be voting instructions returned to LBI, NBLLC or Fidelity Brokerage, as applicable, with respect to such shares. TheExcept with respect to Savings Plan trustee shall vote any shares, for which no proxyvoting instructions are received in the same proportions as the shares for which it has received

instructions.

GENERAL. will be confidential.

General

Unless contrary instructions are indicated, on the proxy or in a

vote registered online or by telephone, all shares represented by valid proxies received pursuant to this solicitation (and not revoked before they are voted)at the Annual Meeting will be voted as follows:

FOR the election of the three nominees for Class I Directors named below;

and

FOR the ratification of the Board of Directors' selection of Ernst & Young LLP as the Company's independent auditors for the 20022005 fiscal year.

FOR the 2005 Stock Incentive Plan; and

AGAINST the shareholder proposal.

In the event a Stockholder specifies a different choice on the proxy or by online or telephone vote, his or her shares will be voted in accordance with the specification so made. Confidential voting is not provided for in the Company's

Restated Certificate of Incorporation or By-Laws.

The Company's 20012004 Annual Report has beento Stockholders is being distributed to Stockholders in connection with this solicitation.A copy (exclusive of exhibits) of the Company's 20012004 Form 10-K as filed with the Securities and Exchange Commission (the "SEC") may be obtained without charge by writing to: Lehman Brothers Holdings Inc., 399 Park Avenue, 11th Floor, New York, New York 10022, Attn.:Attention: Corporate Secretary. The Company's 20012004 Annual Report and 20012004 Form 10-K also will be available through the Lehman Brothers web site at http://www.lehman.com.

COST OF SOLICITATION.

Voting Requirements

Following are the votes required to approve each matter to be considered by Stockholders at the Annual Meeting:

Election of Directors.The three nominees receiving the greatest number of votes cast by the Stockholders will be elected as Class I Directors of the Company. Abstentions and broker non-votes will be disregarded and will have no effect on the vote for directors.

Ratification of the Appointment of Independent Auditors.The affirmative vote of the majority of the shares of Common Stock present in person or by proxy at the Annual Meeting is required to ratify the selection of auditors. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal. Broker non-votes will have no impact on such matter since shares that have not been voted by brokers are not considered "shares present" for voting purposes.

2005 Stock Incentive Plan.The affirmative vote of the majority of the shares of Common Stock present in person or by proxy at the Annual Meeting is required to approve the Plan, provided that a majority of the outstanding shares of Common Stock are voted on the proposal. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal. Broker non-votes are not considered "shares present" for voting

purposes, but may affect the voting to the extent that broker non-votes cause less than a majority of the outstanding shares of Common Stock to be voted on the matter.

Shareholder Proposal.The affirmative vote of the majority of the shares of Common Stock present in person or by proxy at the Annual Meeting is required for adoption of the shareholder proposal. In determining whether the proposal has received the requisite number of affirmative votes, abstentions will be counted and will have the same effect as a vote against the proposal. Broker non-votes will have no impact on such matter since they are not considered "shares present" for voting purposes.

Broker Authority to Vote.If you hold shares through a broker, follow the voting instructions you receive from your broker. If you want to vote in person, you must obtain a legal proxy from your broker and bring it to the meeting. If you do not submit voting instructions to your broker, your broker may still be permitted to vote your shares under the following circumstances:

- •

- Discretionary items.The election of directors and ratification of the selection of auditors are "discretionary" items. Member brokers that do not receive instructions from beneficial owners may vote on these proposals in the following manner: (1) the Company's wholly owned subsidiaries, LBI or NBLLC, or other affiliates of the Company who are New York Stock Exchange ("NYSE") member brokers may vote your shares only in the same proportion as the votes cast by all Stockholders with respect to each such matter; and (2) all other NYSE member brokers may vote your shares in their discretion.

- •

- Non-discretionary items.Approval of the 2005 Stock Incentive Plan and of the shareholder proposal are "non-discretionary" items and maynot be voted on by NYSE member brokers, including LBI and NBLLC, who have not received specific voting instructions from beneficial owners.

Cost of Solicitation

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by directors, officers or employees of the Company in person or by telephone or telegram, or other means of communication, for which no additional compensation will be paid. The Company has engaged the firm of Georgeson Shareholder to assist the Company in the distribution and solicitation of proxies. The Company has agreed to pay Georgeson Shareholder a fee of $11,000$45,000 plus expenses for its services.

The Company also will reimburse brokerage houses, including LBI and NBLLC, and other custodians, nominees and fiduciaries for their reasonable expenses, in accordance with the rules and regulations of the SEC, the New York Stock Exchange and other exchanges, in sending proxies and proxy materials to the beneficial owners of shares of the Company's voting securities.

THE VOTING STOCK. Common Stock.

The Company has two series of voting stock:Voting Stock

The Company's Common Stock, par value $.10 per share (the "Common Stock"), and Redeemable Voting Preferred

Stock, par value $1.00 per share (the "Redeemable Voting Preferred Stock") (the

Common Stock and the Redeemable Voting Preferred Stock are collectively referred

to herein as the "Voting Stock").is its only class of voting stock. As of the Record Date, the following shares of Voting Stock were

outstanding:

- 244,244,497276,029,518 shares of Common Stock (exclusive of 12,059,63223,816,765 shares held in treasury), were outstanding. Stockholders are entitled to one vote per share with respect to each matter to

be voted on at the Annual Meeting, and

- 1,000 shares of Redeemable Voting Preferred Stock, entitled to 1,059 votes per share with respect to each matter to be voted on at the Annual Meeting. There is no cumulative voting provision forapplicable to the Common Stock or Redeemable

Voting Preferred Stock. The Common Stock and the Redeemable Voting Preferred

Stock will vote together as a single class on each matter to be voted on at the

meeting.

The two classes of Voting Stock will represent the following aggregate votes

at the Annual Meeting:

- The Common Stock will represent an aggregate of 244,244,497 votes, or

99.6% of the total number of votes entitled to be cast, and

- The Redeemable Voting Preferred Stock will represent an aggregate of

1,059,000 votes, or 0.4% of the total number of votes entitled to be cast.

The presence in person or by proxy at the Annual Meeting of the holders of a majority of the shares of Common Stock and Redeemable Voting Preferred Stock

outstanding and entitled to vote on the Record Date shall constitute a quorum.

The Incentive Plans Trust holds shares of Common Stock ("Trust Shares") issuable to future, current and former employees of the Company in connection with the granting to such employees of restricted stock unitsRestricted Stock Units ("RSUs") under the Neuberger LTIP, the Company's Employee Incentive Plan (the "Employee Incentive Plan"), the Company's 1994 Management Ownership Plan (the "1994 Plan") and the 2

the 1994

Plan, the "Incentive Plans"). The Incentive Plans Trust provides that the Incentive Plans Trustee will vote or abstain from voting all Trust Shares in accordance withthe same proportions as the RSUs in respect of which it has received voting instructions received from personscurrent employees who have received RSUs under the Incentive Plans ("Current Participants"). For each

Current Participant, the Incentive Plans Trustee shall vote or abstain from

voting, according to instructions received from such Current Participant, with

respect to that number of Trust Shares that results from multiplying (x) the

number of Trust Shares existing on the Record Date by (y) a fraction, the

numerator of which is the number of RSUs held by such Current Participant and as

to which the Incentive Plans Trustee has received voting instructions from such

Current Participant, and the denominator of which is the total number of RSUs

held by all Current Participants and as to which the Incentive Plans Trustee has

received voting instructions. As is the case for all Voting Stock of the

Company, voting instructions given with respect to RSUs will not be

confidential.

As of the Record Date, 49,760,15737,856,526 Trust Shares (representing 20.3%13.7% of the votes entitled to be cast at the Annual Meeting) were held by the Incentive Plans Trust.

STOCKHOLDERS ENTITLED TO VOTE. Trust and 57,282,583 RSUs were held by Current Participants.

The Savings Plan Trustee will vote or abstain from voting any Savings Plan shares for which proxy instructions are received in accordance with such instructions, and will vote or abstain from voting any Savings Plan shares for which no proxy instructions are received in the same proportions as the Savings Plan shares for which it has received instructions. As of the Record Date, 1,331,929 Savings Plan shares (representing 0.5% of the votes entitled to be cast at the Annual Meeting) were held by the Savings Plan Trustee.

Stockholders Entitled to Vote

Only Stockholderscommon stockholders of record as of the close of business on the Record Date are entitled to notice of and to vote at the Annual Meeting or any adjournment thereof.

SECURITY OWNERSHIP OF PRINCIPAL STOCKHOLDERS

To the knowledge of management, except for the Incentive Plans Trust (described above) and as described below,, no person beneficially owned more than five percent of any class of Votingthe Common Stock as of the Record Date.

PROPOSAL 1

1—ELECTION OF CLASS I DIRECTORS

At the Annual Meeting three Class I Directors are to be elected, each to serve until the Annual Meeting in 20052008 and until his or her successor is elected and qualified. The Restated Certificate of Incorporation of the Company establishes a classified Board of Directors with three classes, designated Class I, Class II and Class III. The terms of the Class II and Class III Directors continue until the Annual Meetings in 20042007 and 2003,2006, respectively, and until their respective successors are elected and qualified.

The three nominees for Director are Michael L. Ainslie, John F. Akers and Richard S. Fuld, Jr., who Messrs. Ainslie and Akers were each first elected DirectorsDirector in 1996, 1996 and 1990,

respectively.

The three nominees receiving the greatest number of votes cast by the

holders of the Voting Stock will beMr. Fuld was first elected as Class I Directors of the Company.

Abstentions and broker nonvotes will be disregarded and will have no effect on

the vote for directors. Director in 1990.

Except as stated in the following sentence, the persons specified on the enclosed proxy card intend to vote for the nominees listed below, each of whom has consented to being named in this Proxy Statement and to serving if elected. Although management knows of no reason why any nominee would be unable to serve, the persons designated as proxies reserve full discretion to vote for another person in the event any such nominee is unable to serve.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE

The Board of Directors unanimously recommends a vote FOR ALL NOMINEES.

all Nominees.

The following information is provided with respect to the nominees for Director and the incumbent Directors. Italicized wording indicates principal occupation(s). As discussed below under "Director Independence," the Board of Directors has determined in accordance with the corporate governance rules of the NYSE that Michael L. Ainslie, John F. Akers, Roger S. Berlind, Thomas H. Cruikshank, Marsha Johnson Evans, Sir Christopher Gent, John D. Macomber and Dina Merrill are independent and have no material relationships with the Firm.

NOMINEES FOR ELECTION AS CLASS I DIRECTORS TO SERVE

UNTIL THE 20052008 ANNUAL MEETING OF STOCKHOLDERS

| MICHAEL L. AINSLIE | Director since 1996 | Age: 61 |

Private Investor and Former President and Chief Executive Officer of Sotheby's Holdings.Mr. Ainslie, a private investor, is the former President, Chief Executive Officer and a Director of Sotheby's Holdings. He was Chief Executive Officer of Sotheby's from 1984 to 1994. From 1980 to 1984 he was President and Chief Executive Officer of the National Trust for Historic Preservation. From 1975 to 1980 he was Chief Operating Officer of N-Ren Corp., a Cincinnati-based chemical manufacturer. From 1971 to 1975, he was President of Palmas Del Mar, a real estate development company. He began his career as an associate with McKinsey & Company. Mr. Ainslie is a Director of the St. Joe Company and Artesia Technologies, an internet software provider.Lehman Brothers Bank, FSB. He is a Trustee of Vanderbilt University, and also serves as Chairman of the Posse Foundation, Inc. and Director of the U.S. Tennis Association Foundation. Mr. Ainslie serves as a member of the Audit Committee.

| JOHN F. AKERS | Director since 1996 | Age: 70 |

Retired Chairman of International Business Machines Corporation.Mr. Akers, a private investor, is the retired Chairman of the Board of Directors of International Business Machines Corporation. Mr. Akers served as Chairman of the Board of Directors and Chief Executive Officer of IBM from 1985 until his retirement on May 1,in 1993, completing a 33-year career with IBM. Mr. Akers is a Director of W. R. Grace & Co., The New York Times Company, PepsiCo, Inc. and Hallmark Cards, Inc. He is a former member of the Board of Trustees of the California Institute of Technology and The Metropolitan Museum of Art, as well as the former Chairman of the Board of Governors of United Way of America. Mr. Akers iswas also a former member of former President George Bush's Education

4

Committee

and the Compensation and Benefits Committee.

| RICHARD S. FULD, JR. | Director since 1990 | Age: 58 |

Chairman and Chief Executive Officer.Mr. Fuld has been Chairman of the Board of Directors of the Company and LBI since April 1994 and Chief Executive Officer of the Company and LBI since November 1993. Mr. Fuld serves as the Chairman of the Executive Committee and as Chairman and a nonvoting member of

the Nominating Committee. Mr. Fuld was President and Chief Operating Officer of the Company and LBI from March 1993 to April 1994 and was Co-President and Co-Chief Operating Officer of both corporations from January 1993 to March 1993. He was President and Co-Chief Executive Officer of the Lehman Brothers Division of Shearson Lehman Brothers Inc. from August 1990 to March 1993. Mr. Fuld was a Vice Chairman of Shearson Lehman Brothers from August 1984 until 1990. Mr. Fuld1990 and has been a Director of LBI since 1984. Mr. Fuld joined Lehman Brothers in 1969. Mr. Fuld is a member of the Board of

Governors of the New York Stock Exchange and is Chairman of the U.S. Thailand

Business Council (USTBC). He is also a former member of the President's Advisory

Committee on Trade Policy Negotiations. Mr. Fuld is a trustee of the Mount Sinai Medical Center and former Chairman of the Mount Sinai Children's Center Foundation. He currently serves on the foundation's Executive Committee. In addition, he is a member of the University of Colorado Business Advisory

Council, is a member of the Executive Committee of the Partnership for New York City, PartnershipBusiness Roundtable and The Business Council. Mr. Fuld also serves on the Board of Directors of The Ronald McDonald House.

CLASS II DIRECTORS WHOSE TERMS CONTINUE

UNTIL THE 2004 ANNUAL MEETING OF STOCKHOLDERS

ROGER S. BERLIND DIRECTOR SINCE 1985 AGE: 71

THEATRICAL PRODUCER. Roger S. Berlind, who is also a private investor, has

been a theatrical producer and principalHouse of Berlind Productions since 1981.

Mr. Berlind is also a Director of LBI, a Governor of the League of American

Theaters and Producers and has servedNew York, as a Trustee of Princeton University, the

Eugene O'Neill Theater Center and the American Academy of Dramatic Arts.

Mr. Berlind serveswell as the Chairman of the Audit Committee and as a member of the

Finance Committee.

DINA MERRILL DIRECTOR SINCE 1988 AGE: 73

DIRECTOR AND VICE CHAIRMAN OF RKO PICTURES, INC. AND ACTRESS. Dina Merrill,

a Director and Vice Chairman of RKO Pictures, Inc., is an actress and a private

investor. Ms. Merrill was a Presidential Appointee to the Kennedy Center Board of Trustees and is a Vice President of the New York City Mission Society, a

Trustee of the Eugene O'Neill Theater Foundation and a member of the Board of

Orbis International, the Juvenile Diabetes Foundation and the Museum of

Television and Radio. Ms. Merrill serves as a member of the Compensation and

Benefits Committee and the Nominating Committee.

5

CLASS III DIRECTORS WHOSE TERMS CONTINUE

UNTIL THE 20032006 ANNUAL MEETING OF STOCKHOLDERS

| THOMAS H. CRUIKSHANK | Director since 1996 | Age: 73 |

Retired Chairman and Chief Executive Officer of Halliburton Company.Mr. Cruikshank was the Chairman and Chief Executive Officer of Halliburton Company, a major petroleum industry service company, from 1989 to 1995, andwas President and Chief Executive Officer of Halliburton from 1983 to 1989.1989, and served as a Director of Halliburton from 1977 to 1996. He joined Halliburton in 1969, and served as a Director from 1977 to 1996.in various senior accounting and finance positions before being named Chief Executive Officer. Mr. Cruikshank is a memberDirector of LBI. Mr. Cruikshank serves as the Chairman of the Board of Directors of The Goodyear Tire & Rubber CompanyAudit Committee and

The Williams Companies, Inc. Mr. Cruikshank serves as a member of the AuditNominating and Corporate Governance Committee.

| HENRY KAUFMAN | Director since 1995 | Age: 77 |

President of Henry Kaufman & COMPANY, INC. Company, Inc.Dr. Kaufman has been President of Henry Kaufman & Company, Inc., an investment management and economic and financial consulting firm, since 1988. For the previous 26 years, he was with Salomon Brothers Inc, where he was a Managing Director, Member of the Executive Committee, and in charge of Salomon's four research departments. He was also a Vice Chairman of the parent company, Salomon Inc. Before joining Salomon Brothers, Dr. Kaufman was in commercial banking and served as an economist at the Federal Reserve Bank of New York. Dr. KaufmanHe is a Director of Federal Home

Loan Mortgage Corporation andMember (and the Statue of Liberty-Ellis Island

Foundation Inc. He is the Chairman Emeritus) of the Board of Trustees of the Institute of International Education, a Member of the Board of Trustees of New York University, a Member (and the Chairman Emeritus) of the Board of Overseers of the Stern School of Business of New York University and a Member of the Board of Trustees of the Animal Medical Center. Dr. Kaufman is a Member of the Board of Trustees of the Whitney Museum of American Art, a Member of the International Advisory Committee of the Federal Reserve Bank of New York, a Member of the Advisory Committee to the Investment Committee of the International Monetary Fund Staff Retirement Plan, a Member of the Board of Governors of Tel-Aviv University and Treasurer (and former Trustee) of The Economic Club of New York. Dr. Kaufman serves as the Chairman of the Finance Committee and as a member of

the Nominating Committee.

| JOHN D. MACOMBER | Director since 1994 | Age: 77 |

Principal of JDM INVESTMENT GROUP. Investment Group.Mr. Macomber has been a Principal of JDM Investment Group, a private investment firm, since 1992. He was Chairman and President of the Export-Import Bank of the United States from 1989 to 1992, Chairman and Chief Executive Officer of Celanese Corporation from 1973 to 1986 and a Senior Partner at McKinsey & Co. from 1954 to 1973. Mr. Macomber is a Director of AEA Investors Inc., Mettler-Toledo International, Sovereign Specialty Chemicals, Inc. and Textron Inc. He is Chairman of the Council for Excellence in Government and Vice Chairman of the Atlantic Council. He is a Director of the National Campaign to Prevent Teen Pregnancy and the Smithsonian Institute and a Trustee of the Carnegie Institution of Washington and the Folger Library. Mr. Macomber serves as the Chairmana member of the Compensation and Benefits Committee, and as a member of the Executive Committee and the Nominating and Corporate Governance Committee.

CLASS II DIRECTORS WHOSE TERMS CONTINUE

UNTIL THE 2007 ANNUAL MEETING OF STOCKHOLDERS

| ROGER S. BERLIND | Director since 1985 | Age: 74 |

Theatrical Producer.Roger S. Berlind, who is also a private investor, has been a theatrical producer and principal of Berlind Productions since 1981. Mr. Berlind is also a Governor of the League of American Theaters and Producers and has served as a Trustee of Princeton University, the Eugene O'Neill Theater Center and the American Academy of Dramatic Arts. Mr. Berlind serves as a member of the Audit Committee and the Finance Committee.

| MARSHA JOHNSON EVANS | Director since 2004 | Age: 57 |

President and Chief Executive Officer of American Red Cross.Ms. Evans has been President and Chief Executive Officer of the American Red Cross since August 2002 and previously served as the National Executive Director of Girl Scouts of the U.S.A. from January 1998 until July 2002. A retired Rear Admiral in the United States Navy, Ms. Evans has served as superintendent of the Naval Postgraduate School in Monterey, California from 1995 to 1998 and headed the Navy's worldwide recruiting organization from 1993 to 1995. She is a director of The May Department Stores Company and Weight Watchers International, Inc. She also serves on the Advisory Board of the Pew Partnership for Civic Change, a project of the Pew Charitable Trusts, is a director of the Naval Academy Foundation and a Presidential Appointee to the Board of Visitors of the United States Military Academy at West Point. Ms. Evans serves as a member of the Finance Committee and the Nominating and Corporate Governance Committee.

| SIR CHRISTOPHER GENT | Director since 2003 | Age: 56 |

Non-Executive Chairman of GlaxoSmithKline plc.Sir Christopher Gent has been Non-Executive Chairman of GlaxoSmithKline plc since January 2005. He was Non-Executive Deputy Chairman of GlaxoSmithKline plc from June 2004 to January 2005. Prior to his retirement in July 2003, he had been a member of the Board of Directors of Vodafone Group Plc since August 1985 and its Chief Executive Officer since January 1997. Sir Christopher joined Vodafone as Managing Director of Vodafone Limited in January 1985 when the mobile phone service was first launched, and held that position until December 1996. Prior to joining Vodafone, Sir Christopher was Director of Network Services for ICL. In this role, he was Managing Director of Baric, a computer services company owned jointly by Barclays and ICL, and was responsible for ICL's computer bureau services worldwide. Sir Christopher was Knighted for his services to the mobile telecommunications industry in 2001. He is a Director of the International Advisory Board of Hakluyt & Co. and a Senior Advisor to Bain & Company, Inc. He served as the National Chairman of the Young Conservatives from 1977 to 1979, and was Vice President of the Computer Services Association Council at the time he left ICL. Sir Christopher serves as a member of the Audit Committee and the Compensation and Benefits Committee.

| DINA MERRILL | Director since 1988 | Age: 81 |

Director and Vice Chairman of RKO Pictures, Inc. and Actress.Dina Merrill, a Director and Vice Chairman of RKO Pictures, Inc., is an actress and also a private investor. Ms. Merrill was a Presidential Appointee to the Kennedy Center Board of Trustees and is a Vice President of the New York City Mission Society, a Trustee of the Eugene O'Neill Theater Foundation and a member of the Board of Orbis International, the Juvenile Diabetes Foundation and the Museum of Television and Radio. Ms. Merrill serves as the Chairman of the Nominating and Corporate Governance Committee and a member of the Compensation and Benefits Committee.

COMMITTEES OF THE BOARD OF DIRECTORS

The Executive, Audit, Compensation and Benefits, Finance, and Nominating and Corporate Governance Committees of the Board of Directors are described below.

EXECUTIVE COMMITTEE.

Executive Committee

The Executive Committee consists of Mr. Fuld, who chairs the Executive Committee, and Mr. Macomber. The Executive Committee has the authority, in the intervals between meetings of the Board of Directors, to exercise all the authority of the Board of Directors, except for 6

threeeleven times during the fiscal year ended November 30, 20012004 ("Fiscal 2001"2004").

AUDIT COMMITTEE.

Audit Committee

The Audit Committee consists of Mr. Berlind,Cruikshank, who chairs the Audit Committee, and Messrs. Ainslie and Cruikshank,Berlind and Sir Christopher Gent, all of whom are

non-employeehave been determined by the Board of Directors to be independent directors under NYSE corporate governance rules and are independentSEC rules. The Board of Directors has determined that Mr. Cruikshank is an "audit committee financial expert" as defined in the listing standards

of the New York Stock Exchange.under SEC rules. The Audit Committee operates under a written charter adopted by the Board of Directors.Directors, which is attached hereto as Appendix A and is available through the Lehman Brothers web site at http://www.lehman.com/shareholder/corpgov. The Audit Committee representsassists the Board of Directors in dischargingfulfilling its responsibilities relating to the accounting, reporting

and financial control practicesoversight of the Company.quality and integrity of the Company's financial statements and the Company's compliance with legal and regulatory requirements. The Audit Committee has general

responsibilityis responsible for surveillance of financial controls,retaining (subject to stockholder ratification) and, as well as fornecessary, terminating, the Company's accounting and audit activities. The Audit Committeeindependent auditors, annually reviews the qualifications, performance and independence of the independent auditors makes recommendations to the

Board of Directors as to their selection, reviewsand the audit plan, fees and audit results, and approvespre-approves audit and non-audit services to be performed by the auditors and related fees. The Audit Committee also oversees the performance of the Company's internal audit and compliance functions. The Audit Committee held fourseven meetings during Fiscal 2001.

COMPENSATION AND BENEFITS COMMITTEE. 2004.

Compensation and Benefits Committee

The Compensation and Benefits Committee (the "Compensation Committee") consists of Mr. Macomber,Akers, who chairs the Compensation Committee, and Sir Christopher Gent, Mr. AkersMacomber and Ms. Merrill, all of whom are non-employee Directors.independent under NYSE corporate governance rules. The Compensation Committee establishes corporate policy

and programsoperates under a written charter adopted by the Board of Directors which is available through the Lehman Brothers web site at http://www.lehman.com/shareholder/corpgov. The Compensation Committee has general oversight responsibility with respect to thecompensation and benefits programs and compensation of officersthe Company's executives, including reviewing and employees of the

Firm, including establishingapproving compensation policies and practices, such as salary, cash incentive, restricted stock, long-term incentive compensation and stock purchase plans and other programs, and making grants under such plans. The Compensation Committee also establishes and administers allevaluates the performance of the Company's

employee benefitChief Executive Officer of the Company and compensation plansother members of senior management and, hasbased on such evaluation, reviews and approves the authority, where

appropriate,annual salary, bonus, share and option awards, other long-term incentives and other benefits to delegate its duties.be paid to the Chief Executive Officer and such other members of senior management. The Compensation Committee held fiveeight meetings and acted by unanimous written consent two timesonce during Fiscal 2001.

FINANCE COMMITTEE. 2004.

The Finance Committee consists of Dr. Kaufman, who chairs the Finance Committee, and Messrs. Akers and Berlind.Berlind and Ms. Evans. The Finance Committee reviews and advises the Board of Directors on the financial policies and practices of the Company, and periodically reviews, among other things, major capital expenditure programs and significant capital transactions and recommends a dividend policy to the Board of Directors. The Finance Committee held one meetingtwo meetings during Fiscal 2001.

NOMINATING COMMITTEE. 2004.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the "Nominating Committee") consists of Mr. Fuld,Ms. Merrill, who chairs the Nominating Committee, but is a nonvoting member,Mr. Cruikshank, Ms. Evans and three

non-employee Directors, Messrs. Kaufman andMr. Macomber, and Ms. Merrill.all of whom are independent under NYSE corporate governance rules. The Nominating Committee operates under a written charter adopted by the Board of Directors which is available through the Lehman Brothers web site at http://www.lehman.com/shareholder/corpgov. The Nominating Committee is responsible for overseeing the Company's corporate governance and recommending to the Board of Directors corporate governance principles applicable to the Company. The Nominating Committee also considers and makes recommendations to the Company's Board of Directors with respect to the size and composition of the Board of Directors and Boardits Committees and with respect to potential candidates for membership on the Board of Directors.

The Nominating Committee seeks Director candidates who possess personal characteristics consistent with those who:

- •

- have demonstrated high ethical standards and integrity in their personal and professional dealings;

- •

- possess high intelligence and wisdom;

- •

- are financially literate (i.e., who know how to read a balance sheet, an income statement, and a cash flow statement, and understand the use of financial ratios and other indices for evaluating company performance);

- •

- ask for and use information to make informed judgments and assessments;

- •

- approach others assertively, responsibly, and supportively, and who are willing to raise tough questions in a manner that encourages open discussion; and/or

- •

- have a history of achievements that reflect high standards for themselves and others;

while retaining the flexibility to select those candidates whom it believes will best contribute to the overall performance of the Board of Directors. In addition, the Nominating Committee seeks candidates who will contribute knowledge, expertise or skills in at least one of the following core competencies, in order to promote a Board of Directors that possessesas a whole these core competencies:

- •

- a record of making good business decisions;

- •

- an understanding of management "best practices";

- •

- relevant industry-specific or other specialized knowledge;

- •

- business experience in international markets;

- •

- a history of motivating high-performing talent; and

- •

- the skills and experience to provide strategic and management oversight, and to help maximize the long-term value of Lehman Brothers for its stockholders.

In connection with each annual meeting, and at such other times as it may become necessary to fill one or more seats on the Board, the Nominating Committee will consider in a timely fashion potential candidates for director that have been recommended by the Company's Directors, Chief Executive Officer (the "CEO") and other members of senior management, and stockholders. The Nominating Committee may also engage a third-party search firm as and when it deems appropriate to identify potential candidates for

its consideration. The Nominating Committee will meet such number of times as it deems necessary to narrow the list of potential candidates, review any materials provided by stockholders or other parties in connection with the potential candidates and cause appropriate inquiries to be conducted into the backgrounds and qualifications of potential candidates in order to enable it to properly evaluate the candidates. During this process, the Nominating Committee also reports to and receives feedback from other outside Directors, and meets with and considers feedback from the CEO and other members of senior management, with respect to potential candidates. Interviews of potential candidates for nomination are conducted by members of the Nominating Committee, other outside Directors, the CEO and other members of senior management.

In evaluating any potential candidate, the Nominating Committee considers the extent to which the candidate has the personal characteristics and core competencies discussed above, and takes into account all other factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity and the extent to which a candidate would fill a present need on the Board of Directors. In addition, the Nominating Committee considers independence and potential conflicts issues with respect to Directors standing for re-election and other potential nominees, and whether any candidate has special interests that would impair his or her ability to effectively represent the interests of all stockholders. The Nominating Committee also takes into account the candidates' current occupations and the number of other boards on which they serve in determining whether they would have the ability to devote sufficient time to carry out their duties as Directors.

As indicated above, the Nominating Committee will consider candidates for Director recommended by stockholders of the Company. The procedures for submitting stockholder recommendations are explained below under "Other Matters."

The Nominating Committee held one meetingfive meetings during Fiscal 2001. 2004.

NON-MANAGEMENT DIRECTORS

The Nominating CommitteeBoard of Directors has adopted a policy of regularly scheduled executive sessions where non-management Directors will consider nominees formeet independent of management. At least one executive session per year will include only the independent non-management Directors. The non-management Directors held three executive sessions during Fiscal 2004. The presiding Director recommended

by Stockholders. at the executive sessions is Mr. Macomber.

Stockholders wishing to submit recommendations forof the 2003

Annual Meeting of Stockholders should writeCompany may communicate their concerns to the Corporate Secretary,non-management Directors in accordance with the procedures described on the Lehman Brothers Holdings Inc., 399 Park Avenue, 11th Floor, New York, New York 10022.

The Company's By-Laws contain time limitations, procedures and requirements

relating to Stockholder nominations.

web site at http://www.lehman.com/shareholder/corpgov.

ATTENDANCE AT MEETINGS BY DIRECTORS

The Board of Directors held sixeight meetings and acted by unanimous written consent once during Fiscal 2001.2004. During Fiscal 2001, all Directors2004, each Director attended 75 percent or more of the aggregate of (a) the total number of meetings of the Board of Directors held during the period when he or she was a Director and (b) the total number of meetings held by all Committees of the Board on which he or she served during the period when he or she was a Director.member. Overall Director attendance at Board and Board Committee meetings during Fiscal 2004 averaged 99.3%. The number of meetings held by each Committee during Fiscal 20012004 is set forth above.

7

Each Director is expected to attend the Company's Annual Meeting of Stockholders. Eight out of the nine Directors then in office attended the Company's 2004 Annual Meeting of Stockholders.

COMPENSATION OF DIRECTORS

Non-employee

Cash Compensation for Non-Management Directors

Non-management Directors receive an annual cash retainer of $45,000$55,000 and are reimbursed for reasonable travel and related expenses. The annual retainer is paid quarterly; however, the fourth quarter payment

will be withheld from any Director who has been a Director for the full year for failure to attend 75% of the total number of meetings. In addition,The chairman of the Audit Committee receives an additional annual retainer of $25,000, and each non-employeenon-management Director who servedserves as a chairman of aany other Committee of the Board of Directors receivedreceives an additional annual retainer of $15,000 per Committee, and each

non-employeeCommittee. Each non-management Director who servedserves as a Committee member received $1,500(including as chairman) receives $2,500 per Committee meeting orand $1,500 per unanimous written consent.

RESTRICTED STOCK UNIT AND OPTION GRANTS FOR NON-EMPLOYEE DIRECTORS.

Mr. Ainslie also received an aggregate of $53,000 for serving as a Director, Chairman of the Audit Committee and a member of the Compensation and Benefits Committee of Lehman Brothers Bank, FSB in Fiscal 2004.

Restricted Stock Unit and Option Grants for Non-Management Directors

An annual equity retainer in the form of a grant of 2,500 RSUs is made to each non-employeenon-management Director onas of the day of the Company's Annual Meeting of Stockholders. As of each date that a dividend is paid on Common Stock, each non-employeenon-management Director holding RSUs is credited with a number of additional RSUs equal to the product of (A) the dividend paid on one share of Common Stock, multiplied by (B) the number of RSUs held by the non-employeenon-management Director, divided by (C) the closing price of the Common Stock on the New York Stock Exchange on such date. The RSUs vest immediately and are payable in Common Stock upon death, disability or termination of service.

Alternatively, a non-employeenon-management Director may elect to receive an option to purchase 7,500 shares of Common Stock, with an exercise price per share equal to the closing price of the Common Stock on the New York Stock Exchange on the date the award is made. Such option has a ten-year term, is not forfeitable, and becomes exercisable in one-third increments on each of the first three anniversaries of the award date or, if sooner, upon termination of service.

THE COMPANY'S DEFERRED COMPENSATION PLAN FOR NON-EMPLOYEE DIRECTORS.

The Company's Deferred Compensation Plan for Non-employeeNon-Management Directors

The Company's Deferred Compensation Plan for Non-Management Directors is a nonqualified deferred compensation plan, which provides each non-employeenon-management Director an opportunity to elect to defer receipt of cash compensation to be earned for services on the Board of Directors. Each non-employeenon-management Director may elect to defer all or a portion of his or her future cash compensation with respect to one or more terms as Director. Such election can be revoked only by a showing of financial hardship and with the consent of the Compensation Committee. Amounts deferred are credited quarterly with interest, based upon the average 30-day U.S. Treasury Bill rate, and compounded annually. Deferred amounts will be paid in either a lump sum or in annual installments over a period not to exceed ten years as elected by the non-employeenon-management Director. Payments commence as the non-employeenon-management Director elects, at a specified date in the future or upon termination of service as a non-employeenon-management Director.

THE COMPANY'S FROZEN RETIREMENT PLAN FOR NON-EMPLOYEE DIRECTORS.

The Company's Frozen Retirement Plan for Non-Management Directors

Prior to May 1994, the Company maintained the Company's Retirement Plan for Non-employeeNon-Management Directors which was a nonqualified retirement plan which providedproviding a limited annual retirement benefit for non-employeenon-management Directors who had earned five or more years of service as defined in the plan. Participation in this plan was frozen on May 31, 1994. Any non-employeenon-management Director who had, on such date, completed at least five years of service as a Director (determined in accordance with the plan) has vested benefits under the plan. Any individual who was a non-employeenon-management Director on such date, but had not completed five years of service as of such date, acquired vested benefits under this plan at the time such individual completed such five years of service as a Director. Any individual who became a non-employeenon-management Director after such date was ineligible to participate in this plan. Vested benefits under this plan will be paid after a participant ceases to be a Director. 8

EXECUTIVE OFFICERS OF THE COMPANY

Biographies of the current Executive Officersexecutive officers of the Company (the "Executive

Officers") are set forth below, excluding Mr. Fuld's biography, which is included above. Each Executive Officerexecutive officer serves at the discretion of the Board of Directors.

| JONATHAN BEYMAN | Age: 49 |

Chief of Operations and Technology.Mr. Beyman has been the Chief of Operations and Technology since July 2002 and is an Executive Vice President of the Company. From July 2000 to July 2002, Mr. Beyman was the Firm's Chief Information Officer, from July 1999 to July 2000 he was the Firm's Global Head of Operations, and from March 1999 to July 1999 he was the Firm's U.S. Head of Operations. From December 1997 to February 1999, Mr. Beyman was Chief Operating Officer of Cendant Corporation's Internet-based business, and Chief Information Officer of Cendant from July 1994 to June 1998. Prior thereto, Mr. Beyman was with the Firm for eight years, in a variety of technology and operations senior management roles. Mr. Beyman is a member of the Board of Directors of the Depository Trust & Clearing Corporation and Dice, Inc. and a member of the NY Advisory Board of Donors Choose.

| DAVID GOLDFARB | Age: 47 |

Chief Administrative Officer.Mr. Goldfarb has been the Chief Administrative Officer of the Company since December 2004 and is an Executive Vice President of the Company and a member of the Firm's Executive Committee. Mr. Goldfarb served as the Chief Financial Officer of the Company sincefrom April 2000 to December 2004 and is a member of the Firm's Operating

Committee.LBI from July 1998 to December 2004. Mr. Goldfarb served as the Company's Controller from July 1995 to April 2000. Mr. Goldfarb has been the Chief Financial Officer of LBI since

July 1998. Mr. Goldfarb joined the Firm in 1994;December 1993; prior to that, Mr. Goldfarb was a partner at Ernst & Young.

Young LLP.

| JOSEPH M. GREGORY | Age: 53 |

President and Chief Operating Officer.Mr. Gregory has been thePresident and Chief AdministrativeOperating Officer of the Company since May 2004 and is a member of the Firm's Executive Committee. From May 2002 until May 2004, Mr. Gregory was the Firm's Co-Chief Operating Officer. From April 2000. From2000 until May 2002, Mr. Gregory was the Firm's Chief Administrative Officer, and from 1996 to April 2000, Mr. Gregory was Head of the Firm's Global Equities Division, in charge of the overall equities business. Mr. Gregory is also a member of the Firm's Executive Committee and

Operating Committee. From 19941991 to 1996, he was HeadCo-Head of the Firm's Fixed Income Division. He was named Co-Head of the Fixed Income Division in 1991. From 1980 to 1991, he held various management positions in the Fixed Income Division, including Head of the Firm's Mortgage Business. Mr. Gregory joined the Firm in 1974 as a commercial paper trader. Mr. Gregory is a member of the Board of Directors of The Posse Foundation, Inc. and of the Dorothy Rodbell Cohen Foundation.

Board of Trustees of The Millbrook School. He is a Trustee of Hofstra University and serves on the Finance, Endowment and Investment Committees of the University.

| CHRISTOPHER M. | Age: 43 |

Chief Financial Officer.Mr. IsaacsO'Meara has been the HeadChief Financial Officer of the Firm's Asian operationsCompany since December 2004 and is an Executive Vice President of the Company. In addition, he has served as the Company's Global Controller since April 2000 and Head of2002. Prior to serving as Global Controller, he served as Financial Controller since April 2001. Mr. O'Meara served as the Firm's European

operations since December 1999.Company's Assistant Controller from July 1995 until April 2001. He is also a member of the Firm's Executive

Committee and Operating Committee. Mr. Isaacs joined the Firm in 1996 as

Co-Chief Operating Officer, European Equities,1994 and later that year becamehas held various management positions in the Finance Division, including Head of Expense Management, Chief Financial Officer of the Investment Banking Division and Head of Financial Management Information.

| THOMAS A. RUSSO | Age: 61 |

Chief Legal Officer.Mr. Russo has been Chief Legal Officer of the Company since 1993 and is an Executive Vice President of the Company. Mr. Russo also serves as counsel to the Firm's global equity derivatives activities. In 1997 he additionally

became HeadExecutive Committee. He has been a Vice Chairman of LBI since July 1999. Mr. Russo joined the Firm's overall equities activitiesFirm in Europe. In March 1999

he1993; prior to that, Mr. Russo was appointed Chief Operating Officera partner at the Wall Street law firm of European activities,Cadwalader, Wickersham & Taft and in

December 1999 was appointed Chief Executivea member of the Firm's European activities.

Prior to joining Lehman Brothers,its Management Committee. Mr. Isaacs was an Executive Director at

Goldman Sachs, a firm he joined in 1989. Mr. IsaacsRusso is a member of the Advisory

Board (Europe, Middle East and Asia Region) of Electronic Data Systems

Corporation.

BRADLEY H. JACK AGE: 43

HEAD OF INVESTMENT BANKING DIVISION. Mr. Jack has been the Head of the

Firm's Investment Banking business since 1996. Mr. Jack is also a member of the

Firm's Executive Committee and Operating Committee. From 1993 to 1996 he was a Sector Head in Investment Banking, responsible for the Firm's businesses

involving Debt Capital Markets, Financial Services, Leveraged Finance and Real

Estate. Prior to that he was headVice Chairman of the Firm's Fixed-Income Global Syndicate

activities. Mr. Jack joinedNational Board of Trustees of the Firm in 1984 as an associate in the Fixed Income

Division. Mr. Jack is a memberMarch of Dimes, Vice Chairman of the Board of DirectorsTrustees of The Institute for Financial Markets, and Chairman of the Dorothy Rodbell

Cohen Foundation and a memberExecutive Committee of the Board of Trustees of the Juilliard School.

JEFFREY VANDERBEEK AGE: 44

HEAD OF CAPITAL MARKETS DIVISION. Mr. VanderbeekInstitute of International Education. He is Headalso Co-Chairman of the Firm's

Capital Markets Division and previously served as Co-Head of that Division. From

1996 to April 2000, Mr. Vanderbeek was Head of the Fixed Income Division, in

charge of the overall fixed income business. Mr. Vanderbeek is also a member of

the Firm's Executive Committee and OperatingGlobal Documentation Steering Committee. He became Chief

Operating Officer of the Fixed Income Government Department in May 1993 and

Chief Operating Officer of the Fixed Income Derivatives Department in

June 1993. Mr. Vanderbeek joined Lehman Brothers in February 1984 as Managing

Director and Chief Operating Officer in the Fixed Income Central Funding

Department. Mr. Vanderbeek is a member of the Board of Directors of the Dorothy

Rodbell Cohen Foundation.

9

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth beneficial ownership information as of January 31, 20022005 with respect to the Common Stock for each current Director of the Company (including all nominees for Director), each Executive Officerexecutive officer named in the tables set forth under "Compensation of Executive Officers" below and all current Directors and Executive Officersexecutive officers as a group. Except as described below, each of the persons listed below has sole voting and investment power with respect to the shares shown. None of the Directors or Executive Officersexecutive officers beneficially owned any of the Company's other outstanding equity securities as of January 31, 2002.

| Beneficial Owner | Number of Shares of Common Stock (a) | Number of Shares of Common Stock that may be acquired within 60 days of January 31, 2005 | Percent of Outstanding Common Stock (b) | |||

|---|---|---|---|---|---|---|

| Michael L. Ainslie (c) | 26,511 | 30,798 | * | |||

| John F. Akers (d) | 13,554 | 7,500 | * | |||

| Roger S. Berlind (e) | 294,219 | 30,798 | * | |||

| Jonathan Beyman | 121,146 | 32,585 | * | |||

| Thomas H. Cruikshank | 31,603 | 0 | * | |||

| Marsha Johnson Evans | 2,516 | 0 | * | |||

| Richard S. Fuld, Jr. (f) | 4,504,154 | 1,516,666 | 2.17 | |||

| Sir Christopher Gent | 5,586 | 0 | * | |||

| David Goldfarb | 321,073 | 509,312 | * | |||

| Joseph M. Gregory | 2,210,161 | 500,000 | * | |||

| Henry Kaufman (g) | 33,939 | 28,394 | * | |||

| John D. Macomber | 64,752 | 28,298 | * | |||

| Dina Merrill | 22,184 | 30,798 | * | |||

| Thomas A. Russo | 501,505 | 175,000 | * | |||

| All current Directors and executive officers as a group (15 individuals) | 8,202,979 | 2,911,906 | 3.98 |

- *

- Less than one percent.

- (a)

- Amounts include vested and unvested RSUs. RSUs are convertible on a one-for-one basis into shares of Common Stock, but cannot be sold or transferred until converted to Common Stock and, with respect to each person identified in the table, are not convertible within 60 days following January 31,

2002.2005. A portion of the vested RSUs held by theExecutive Officersexecutive officers are subject to forfeiture for detrimental or competitive activity. Nonetheless, anExecutive Officerexecutive officer who holds RSUs will be entitled to direct the Incentive Plans Trustee to vote a number of Trust Shares that is proportionate to the number of RSUs held irrespective of vesting; such number of Trust Shares will be calculated prior to the Annual Meeting and will be determined by the number of Trust Shares held by the Incentive Plans Trust on the Record Date and the extent to which Current Participants under the Incentive Plans return voting instructions to the Incentive Plans Trustee. See"Introduction--The"Introduction—The Voting Stock." - (b)

- Percentages are calculated in accordance with applicable SEC rules and are based on the number of shares issued and outstanding on

the Record Date.January 31, 2005. - (c)

- Includes 3,500 shares held by Mr. Ainslie's private charitable foundation, over which he and his wife share voting and investment power and as to which Mr. Ainslie disclaims beneficial ownership.

- (d)

- Includes 7,500 shares that may be acquired within 60 days of January 31, 2005 pursuant to stock options held by a family limited partnership, the general partner of which is a family limited liability company of which Mr. Akers is manager. Mr. Akers disclaims beneficial ownership of such shares.

- (e)

- Includes 80,000 shares held by Mr. Berlind's wife, as to which Mr. Berlind disclaims beneficial ownership.

(e) - (f)

- Includes a total of 11,670 shares held by Mr. Fuld's children and a total of 37,791 shares held by trusts for Mr. Fuld's children, of which Mr. Fuld and his wife are the trustees. Mr. Fuld disclaims beneficial ownership of such shares.

- (g)

- Includes 25,000 shares held by Dr. Kaufman's wife, as to which Dr. Kaufman disclaims beneficial ownership.

10

COMPENSATION COMMITTEE REPORT ON EXECUTIVE OFFICER COMPENSATION

Compensation Governance and Policies

The Compensation Committee oversees the compensation and benefit programs of the Company and the evaluation of the Company's management, with particular attention given to the compensation of the Company's Chief Executive Officer and the other Executive Officers.senior executives. The Compensation Committee is comprised of four non-employee Directors, including Mr. Macomber,Akers, who chairs the Compensation Committee, Sir Christopher Gent, Mr. AkersMacomber and Ms. Merrill.

InMerrill, all of whom are independent under NYSE corporate governance rules. The Compensation Committee operates pursuant to a written charter that was amended and restated in January 2004 which is available through the Lehman Brothers web site at http://www.lehman.com/shareholder/corpgov.

The Compensation Committee has an established compensation philosophy that is reviewed annually and provides the foundation for making its decisions with respect to the Company's compensation and benefit programs in general and the compensation of Executive

Officers,its executive officers. Aligned with the Compensation Committee has adoptedphilosophy are a number of key operating principles that are the following philosophical

positionsbasis for designing programs to motivate behaviors that drive the Company's performance. These principles include the following:

- •

- Tie compensation for executive officers to annual and

policies: -long-term Firm, business unit and individual performance goals that are structured to align the interests of executive officers with those of stockholders. - •

- Deliver a significant portion of total compensation in equity-based awards, thereby further aligning the financial

interestinterests ofExecutive Officersexecutive officers with those of stockholders and encouraging prudent long-term strategic decisions.Where feasible, based on market conditions and other factors, shares will be repurchased in the market to avoid stockholder dilution. - Tie compensation for Executive Officers to both annual and long-term performance goals, which further aligns the interests of Executive Officers with those of stockholders and rewards Executive Officers for achievements. - - •

- Ensure that compensation opportunities are comparable with those at major competitors, so that the Firm

may recruitcan attract, retain andretainmotivate talentedExecutive Officersexecutive officers who arekeyessential to the Company's long-term success.

The overall objective in determining total compensation levels across the Firm is to balance competitive pressures in the market for professional talent with cost considerations. The elements and weightings of the compensation program at the Company are comparable to those used by others in the investment bankingsecurities industry, but are considerably different from those of other major corporations operating in different industries. The securities industry typically pays higher levels of

compensation than other industries, such as manufacturing, transportation,

utilities or retail. The nature of the securities industry requires that the

workforce consist of a large percentage of highly skilled professionals, who are in great demand due to the revenue they can generate. Competitive pressure to hire these professionals results in high levels of compensation in order to attract and retain the talent needed to compete effectively.

Total

Compensation Program for Fiscal 2004

Consistent with prior years, total compensation is comprised of base salary and both cash and noncashequity incentive compensation. Base salaries are intended to make up a small portion of total compensation. The greaterlarger part of total compensation, incentive compensation, is based on the Company's financial performance and other factors and is delivered through a combination of cash bonuses and equity-based awards. This approach results in overall compensation levels which followthat reflect the financial performance of the Company.

As in years past, a

A key elementcomponent of Executive Officerexecutive officer compensation for Fiscal 20012004 is annual incentives based on compensation formulas pursuant to the Company's Short-Term Executive Compensation Plan. The Short-Term Executive Compensation Plan was a pre-establishedapproved by stockholders in 2003 and is designed to preserve the tax deductibility of compensation formula, which in excess of $1 million under Section 162(m) of the Internal Revenue Code. The Compensation Committee establishes compensation formulas at the beginning of the year that incorporate the Company's financial objectives. For Fiscal 2001 was2004 the Committee established

formulas based on the Company's return on equity.pre-tax income, for which the Company earned a record $3.5 billion for the year, an increase of 39% over Fiscal 2003. The formulas wereare intended to provide a specific amount of annual compensation,incentive, which is paid in the form of a cash bonus and Restricted Stock Units ("RSUs"). The RSUs, of which 35% vest after three years and the remaining 65% vest after five years, are subject to significant vesting andadditional forfeiture restrictions and cannot be sold or transferred until converted to Common Stock.

Additionally, Fiscal 2001 Stock at the end of five years. Due to the significant limitations imposed on the RSUs, for purposes of compensating employees RSUs are discounted by 30% from the stock's trading price.

Executive Officerofficer compensation includedalso includes a long-term incentive plan, the 2000 Performance Stock Unit ("LTIP"PSU") program, as a component of total compensation. Whereas the cash bonus and RSU components of total compensation are based upon annual performance goals, the LTIP awards Performance Stock Units ("PSUs") over a

longer period. Under the current LTIP,PSU program was based upon the Company's return on equity as well as anya specified level of stock price appreciation in the Common Stock over a three and one-half year period whichthat began June 1, 2000 will determine an award2000. The PSUs convert to freely transferable shares of RSUsLehman Brothers common stock upon vesting, which will vestoccurs in one-third increments in 2006 through 2008. The performance component of the LTIP

seeksPSU program was designed to further align executive performance with Stockholder interests. Thestockholder interests while the additional vesting componentaspect seeks to encourage the retention of talentedthe executives particularly ifwhile motivating them to sustain and improve the Company's return on equity and stock price result in a

meaningful award.

company's performance over future periods.

The Compensation Committee also utilized stock option awards in Fiscal 20012004 to further encourage Executive Officersexecutive officers to strive for long-term Stockholderstockholder value. TheStock options to selected executive officers were awarded with 11

in three years if and when the market price of the Common Stock increases toexceeds a level well above the marketspecified target price, on the date of

grant.but no earlier than 2 years. However, if the target price targets areis not achieved, exercisability for all or

a portion of the options is delayed until four and one-half years after the date of grant. For 2004 the target stock price was set by the Compensation Committee at $90.00, approximately 26% above the fair market value of $71.39 on the grant date. The stock options expire five years after the date of grant. The Compensation Committee believes that stock options assistsupport the FirmFirm's compensation philosophy in maintaining a competitive compensation program.

In determining overall Executive Officer compensation for Fiscal 2001, theits pay-for-performance culture.

The Compensation Committee also consideredanalyzed a numbervariety of business factorsfirm-wide, divisional, and conditions. Despiteindividual performance measures when determining executive officer Fiscal 2004 total compensation. These included financial and non-financial measures of performance that were evaluated on both an absolute and comparative basis, and included the difficult economicfollowing:

- •

- Performance of the Firm's stock price relative to competitors in the current year and

market conditions and the impact of September 11, the Company reported its second best year ever in terms of revenues and net incomeover time; - •

- Record financial results in Fiscal

2001. The Company has continued2004, including:- •

- Net revenues of $11.6 billion, which increased 34% over 2003 and included record net revenues within each of the Company's business segments: Investment Banking, Capital Markets and Client Services;

- •

- Pre-tax income of $3.5 billion, reflecting a 39% increase over the $2.5 billion earned in Fiscal 2003;

- •

- Net income increase of 39% to

deliver strong performance$2.4 billion; and - •

- Earnings per share of $7.90, which increased 24% from $6.35 in

termsFiscal 2003;

- •

- Strengthening the Company's balance sheet, including increasing total capital and total stockholders' equity and reducing net leverage;

- •

- Achievement of a return on equity

relativeof 17.9% and a return on tangible equity of 24.7%, compared tocompetitor firms.18.2% and 19.2%, respectively, for Fiscal 2003; - •

- Market share gains in the Company's business units;

- •

- Strengthening the Firm's infrastructure and control functions, including investments in technology and risk management; and

- •

- Enhancing the Firm's culture and work environment through broad diversity initiatives, improved work-life balance programs and enhanced internal communications.

In addition, the Compensation Committee reviewed current compensation of a larger group of the Company's senior management team as well as compensation provided in prior years to ensure that the prior

year, along withexecutive compensation program provides awards that are internally equitable. The Compensation Committee also reviewed historical compensation levels and financial performance among other large financial services firms and estimates of compensation for the current year, for competitor

firms. In making its determinations,year. These firms included Bank of America Corp., The Bear Stearns Companies Inc., Citigroup Inc., Federal National Mortgage Association, The Goldman Sachs Group, Inc., JPMorgan Chase & Co., Merrill Lynch & Co., Inc., Morgan Stanley, Wachovia Corp., and Wells Fargo & Co. However, the Compensation Committee had availablegives greater consideration to those firms with which Lehman Brothers competes more directly.

In carrying out its responsibilities, the Compensation Committee has the authority to select, retain and terminate outside counsel and other experts to study or investigate any matter of interest that it third-party advisors knowledgeable aboutdeems appropriate. The Compensation Committee engaged an external compensation consulting firm specializing in the financial services industry, Johnson Associates, to assist it with benchmarking and compensation analysis and to provide on-going consulting on executive compensation practices.

Compensation of the Chairman and Chief Executive Officer for Fiscal 2004